A new superstar has emerged in the AI world.

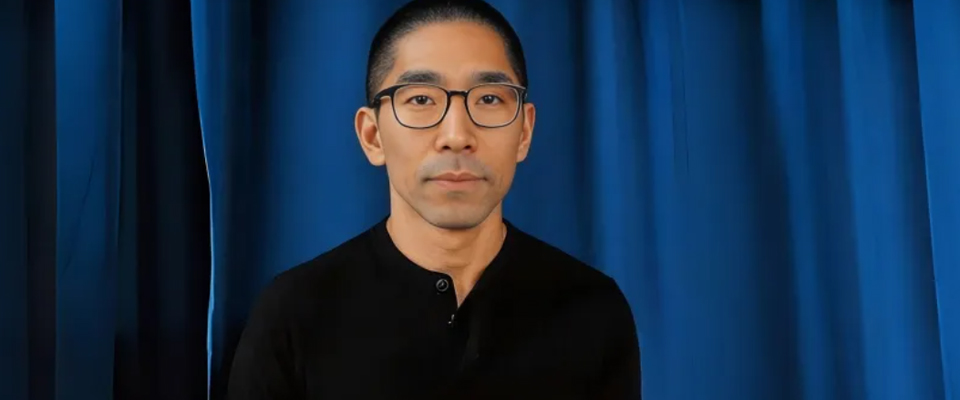

Edwin Chen, a Chinese-American tech entrepreneur, is rapidly becoming the next AI powerhouse. According to Forbes, his startup Surge AI is currently raising $1 billion in its Series A funding, pushing the company’s valuation to an estimated $24 billion.

Graduating from MIT, Chen built his career at hedge funds, Google, and Facebook before launching his own venture at the age of 32. Over the past five years, Surge AI has never taken external funding yet has achieved annual revenues exceeding $1 billion—a true legend in AI entrepreneurship.

Now, thanks to his 75% stake in the company, Chen’s net worth has skyrocketed to $18 billion, earning him a spot on Forbes’ list of the youngest billionaires in the U.S. this year.

Surge AI: The Data Goldmine Behind the AI Boom

Surge AI, once just a topic among AI investors, has now become a hot commodity. Founded in 2020 when Chen left his stable tech career, the company’s core business is essentially “selling shovels” for AI: providing high-quality data labeling services. Despite never taking outside investment, Surge quietly surpassed $1 billion in revenue.

By comparison, better-known rivals like Scale AI have drawn huge attention—Meta invested $15 billion in Scale AI this past June, valuing it at over $29 billion. Scale’s co-founder, Lucy Guo, became the world’s youngest self-made female billionaire with a 5% stake.

There’s a famous saying in AI circles: “Where there’s manpower, there’s intelligence.” Data labeling companies rely on massive outsourced teams to curate data, earning nicknames like “Cyber Foxconn.” Yet their role is critical: no matter how advanced AI becomes, clean, well-labeled data is indispensable for training models.

In the AI ecosystem, data, algorithms, and computing power form the three pillars. While NVIDIA sells computing power, data labeling companies like Surge AI sell data—the foundation upon which AI breakthroughs are built. This explains why valuations of Surge AI and Scale AI soar into tens of billions.

The Rise of a Young Tech Titan

Chen had been under the radar for years. But now, with his 75% stake, he officially becomes one of the youngest billionaires in America.

“If I hadn’t founded Surge, I’d still be doing data mining and AI training. It’s just the field I was meant to work in,” Chen said humbly about his meteoric wealth.

Born in 1988 to a family running a modest Chinese restaurant, Chen showed early brilliance in math and science fiction. By age 8, he was teaching himself calculus; by 17, he entered MIT to study mathematics, linguistics, and computer science.

After graduation, he joined Peter Thiel’s hedge fund, Clarium Capital, then moved on to tech giants including Twitter, Google, and Facebook, focusing on AI and data projects.

The idea for Surge AI struck when Chen’s team faced a project that required labeling 50,000 data entries. Outsourcing took six months and produced low-quality results—slang, memes, and tags were all mislabeled.

“If even the giants can’t get it right, there’s a massive opportunity,” Chen realized. In 2020, he left his stable job and founded Surge AI.

From Apartment Startup to AI Giant

Chen’s early days were humble—writing the first product version alone in his apartment, landing initial clients through chance meetings at a San Francisco climbing gym. Within a year, Surge AI reached eight-figure revenue and was perfectly positioned to ride the surge of large language models (LLMs).

“AGI won’t emerge from messy data. Simple labeling may seem boring, but high-quality input is the foundation for solving truly complex AI problems,” Chen explains. He emphasizes hiring top-tier engineers—claiming that scaling AI excellence requires 100x more engineering talent.

Partnerships with OpenAI, Anthropic, and other LLM leaders have cemented Surge AI’s reputation. Today, the company has 250 employees, serving major AI players including OpenAI, Google, Microsoft, Meta, and Anthropic. Meta alone spent over $150 million on Surge’s end-to-end labeling services last year.

“We’re solving problems that are critical for every AI model,” Chen says. “Without us, AGI isn’t possible.” He envisions AI capable of writing Nobel-winning poetry, tackling the Riemann Hypothesis, and uncovering the universe’s secrets—provided the data reflects human expertise, creativity, and values.

AI Wealth Boom: A Global Phenomenon

AI-generated wealth continues to surge. This month, AI search engine Perplexity secured $200 million in funding, valuing the company at $20 billion. Founded in 2022 by three Gen Z prodigies, it has raised $1.5 billion in just three years.

Similarly, French startup Mistral AI is about to close €2 billion in funding, pushing its valuation to €12 billion. Founded by three graduates of top Paris universities, the team secured $100 million in seed funding with a 7-page pitch deck—setting a European record.

From stock markets to AI unicorns, the rush is undeniable. NVIDIA and Oracle shares hit record highs, while Chinese AI chip leader Cambricon surpassed Kweichow Moutai to become the new market leader, with a market cap over $600 billion. Other high-performing companies include HiSilicon and industrial AI firms that have doubled in value in under five months.

As NVIDIA CEO Jensen Huang predicts, the next five years may produce more AI-driven millionaires than the internet did in 20 years.

Yet caution looms. Analyst Henry Blodget warns: “When AI shifts from boom to bust, the shockwaves will surpass tech alone. Are we years from a bubble burst, or just months?”

History shows that every tech revolution generates wealth legends—and casualties. In the AI golden era, some have already reached for the stars, while many others are still waiting for the wind to rise.