Recently, Europe’s venture capital scene has seen a surge of “work harder, dream bigger” rhetoric. Prominent figures like Nik Storonsky of Revolut, Harry Stebbings of 20VC, and Martin Mignot of Index Ventures have openly championed the grind, encouraging startups to embrace long hours and high ambition. Stebbings didn’t mince words: “Europe’s problem is simple: if you claim you want to build a $10B company but stick to 9-to-5, five days a week, you’re fooling yourself.”

Yet, Europe’s AI venture scene has long lagged behind the US and China. Phenomenal AI products like Deepseek, ChatGPT, Claude, and Manus emerged outside Europe. In 2023, AI venture funding in Europe totaled just $8B, versus $68B in the US and $15B in China. Even by 2024, despite some catch-up, Europe’s AI investment reached only $11B, compared to $47B in the US, with the market heavily concentrated in a few startups.

This slow growth prompted even former European Central Bank president and ex-Italian Prime Minister Mario Draghi to note: “Technology should be Europe’s backbone, yet it remains its weakest link.”

A Game-Changing Move: ASML Invests in Mistral AI

Europe may finally have a reason to celebrate. AI unicorn Mistral AI recently closed a landmark €1.7B Series C round (≈$1.42B), valuing the company at €11.7B (≈$9.8B). The headline isn’t just the funding size—it’s who joined the round: DST, A16z, General Catalyst, Index Ventures, Lightspeed, NVIDIA, and one particularly surprising name for Europeans and global tech watchers alike: ASML.

Why would the lithography giant invest in an AI startup?

ASML didn’t just participate—it led the round, contributing €1.3B (~$1.09B) for an 11% stake. In effect, Europe’s most iconic tech manufacturer has formed a strategic alliance with the continent’s highest-valued AI unicorn—a collaboration with symbolic and practical weight.

European media framed this as a bold move to reclaim technological sovereignty. Yahoo commented: “This partnership highlights Europe’s effort to reduce dependence on US tech… especially as political tensions with the US rise.” Clara Chappaz, France’s Deputy Minister for Digital and AI, celebrated on social media: “Europe’s tech sovereignty will be built through you.”

Business First, Politics Second

Despite the hype, ASML’s move is likely driven by business considerations. Reports indicate that ASML and Mistral share a vision of applying AI to industrial manufacturing. Mistral plans to invest its funds into “customized, decentralized AI solutions” for complex engineering and industrial challenges, while ASML sees Mistral’s AI expertise as a way to enhance its lithography tools and services. CEO Christophe Fouquet explained: “Mistral offers more than models—they help us develop better solutions for clients and improve our operations.”

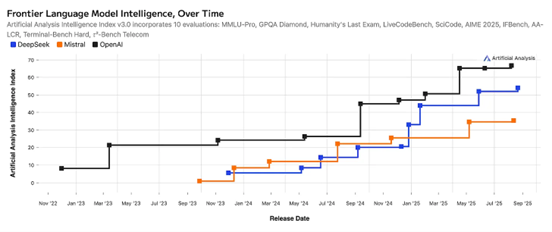

Yet, the reality is nuanced. Mistral holds only a 2% market share in the large-language-model sector, trailing behind Deepseek and OpenAI. Their revenue depends heavily on a handful of large industrial contracts, making scalability and long-term sustainability uncertain. Some analysts argue Mistral’s high valuation reflects political and strategic positioning as much as market performance—co-founder Cedric O. previously served in Macron’s government, enhancing the startup’s influence in Europe.

Moreover, ASML’s investment history shows a pattern: past investments like Cymer and SMART Photonics align tightly with its semiconductor business. Investing in Mistral suggests a calculated bet on AI as a complement to its core industrial strength rather than a speculative tech gamble.

A Strategic European Play

This investment reflects a broader trend in Europe: instead of competing head-to-head with US and Chinese AI giants, European VCs are focusing on vertical AI applications. By August 2025, Europe had funneled $5.8B into AI applications for industry, healthcare, and other sectors—63.5% of total AI funding. Investors favor vertical AI because it requires smaller datasets, lower costs, and quicker validation than building large general-purpose AI models.

In healthcare, for instance, European startups like Isomorphic Labs and Neko Health have attracted multi-million-dollar investments, demonstrating strong interest in practical AI solutions over consumer-facing chatbot products.

For ASML and Mistral, this means a chance to “overtake on the curves”: leveraging Europe’s mature industrial base while avoiding direct competition with global AI giants. It’s both a confidence booster for European tech and a potentially viable path for Mistral to pivot from consumer AI to industrial applications.

Europe’s Long Game

As Draghi suggested, Europe must invest strategically in disruptive tech—AI, semiconductors, and advanced manufacturing—through programs like Horizon Europe. But rebuilding technological leadership isn’t just about funding; it’s about time, talent, and consistent execution. Between 2008 and 2021, Europe produced 147 unicorns, yet nearly a third relocated abroad, mainly to the US. Catching up will require patience and smart positioning—something ASML’s bet on Mistral could help initiate.

In short, ASML’s €1.3B investment may be as much about strategic foresight and European industrial resilience as it is about immediate returns. For the continent, it’s a rare opportunity to reclaim influence in the global AI arena while staying true to its industrial DNA.